Health Savings Accounts are a flexible option for out of pocket expenses. Since 2011, HSAs have seen a rise in popularity, growing from 6.76 million accounts to more than 22 million in 2018. 2016-2017 alone saw a 9% increase in HSA enrollment.

Each new year brings changes to the maximum amount that can be contributed to HSA accounts. Don’t let upcoming changes to 2020 HSA contribution limits catch you off guard.

The IRS has increased the limit on HSA contributions next year for both individual coverage and family coverage. 2020 is only a few months away, so why not refresh your HSA knowledge basics now and catch up on next year’s changes before they go into effect in the coming year?

Back to Basics

The ins and outs of health savings accounts are complex and far lengthier than what we can cover here, but it is always good to have a refresher on the basics.

A health savings account (HSA) is a tax-favored savings account created for the purpose of paying medical expenses. They’re 100% tax-deductible, and withdrawals made to cover expenses are never taxed. Interest earned on contributions is also tax-deferred, and tax-free if used to pay for medical expenses.

To qualify to contribute to a health savings account, you must have a health insurance policy with a deductible of at least $1,350 for single coverage or $2,700 for family coverage. This is known as a high-deductible health plan.

For an individual with a high-deductible health plan, their employer, spouse, or loved ones can contribute to their HSA completely tax-free. In most cases, these contributions come in the form of a payroll deduction, but contributions from take-home pay can be made as well.

All qualifying contributions reduce an individual’s taxable income and count toward an annual contribution limit. Employer contributions are included in these limits as well.

These contribution limits are adjusted each year to account for inflation.

Know Your Plan

When it comes to HSA accounts, it is best to get an HSA-eligible high deductible plan through an employer. Employers typically have a specific HSA provider that contributes to the account through payroll deductions.

This is best because payroll deductions are typically exempt from social security and medicare taxes.

Speaking of Medicare

Anyone enrolled in Medicare by law cannot contribute to an HSA. Any HSA contributions made prior to medicare enrollment, however, can be used for medical expenses.

Age Matters

It is important to remember that anyone age 55 and older can contribute an additional $1,000 to their HSA at the end of each year. This is known as a “catch up” contribution.

If the account holder’s spouse is also 55 or older, both can contribute the additional $1,000 catch up contribution.

With that said, if a spouse is not 55 or older, a separate account must be opened to contribute the additional $1,000.

There are no joint HSA accounts. If the account holder’s spouse has already contributed the maximum amount allowed, the couple must have two accounts to contribute to the maximum possible amount.

So what’s happening in 2020?

Changes to HSA contribution limits are usually announced by the IRS at the start of the year. This means that the changes being put in place in 2020 were announced in May this year.

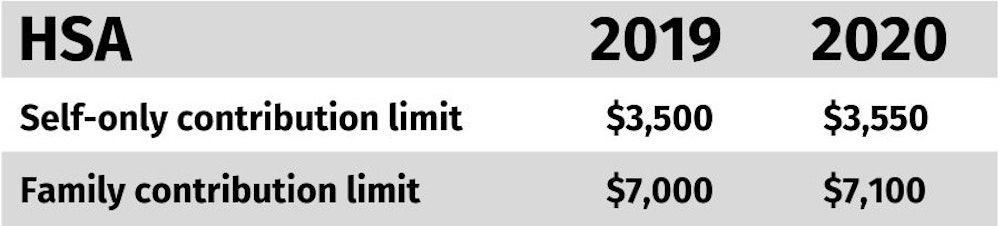

For individual coverage plans, contribution limits will increase by $50. Those with family coverage will see a limit increase of $100 in the new year.

Anyone who follows the annual HSA contribution limit changes won’t be surprised by those figures-- they follow the increasing trend that has occurred over the last few years. In 2019 the limit also increased by $50 and $100 dollars for individual and family coverage, respectively.

*source: Discovery Benefits and the IRS

What is the Max 2020 HSA Contribution?

Bonus contributions for the 55 and older crowd are still $1,000, as those are not impacted by inflation. That means that anyone who qualifies for this “catch up” contribution can contribute a maximum of $4,550 for self-coverage and $8,100 for family coverage.

Stay One Step Ahead

The world of medical expenses and insurance will always be tricky, but knowing your maximum HSA contribution limit will help you stay ahead of the game and plan for the coming year. Remember, HSA contribution limits for 2021 will be announced by the IRS in just a few short months!