At the core of every business’s success, is the hours its employees put into building it. But to stay profitable, business owners need to be accurate with their employee time tracking, for multiple reasons.

From staying compliant to continued profitability, employee time tracking is a necessity for your business to stay competitive.

What Is Time Tracking?

Employee time tracking is the recording of hours your employees spend working, so you can pay them accurately and stay compliant with Fair Labor Standards Act (FLSA) timekeeping requirements.

It also helps you keep accurate records for taxes, audits, budget analysis, and paid time off. For companies that do government contracts, tracking employees’ time must be accurate and detailed to avoid delays in payments or, worse, non-payment.

What About The Exempt Employee Time Tracking Policy?

An exempt employee is one who is usually salaried and is not entitled to overtime pay, according to the FLSA. However, there are benefits to having exempt employees clock in to track their hours, especially in construction and field service companies:

- Accurate billing and invoicing

- Accurate payroll records

- Easily track PTO

- Calculate overtime costs

- Better project management

While the law does not require employers to track exempt employees' hours, having an exempt employee time-tracking policy will help your business in these ways.

An effective policy can be simple. It can be as simple as requiring them to use the same employee time-tracking system your non-exempt employees use.

Why Is Time Tracking Important?

Termed “The Most Dangerous Phrase in Business,” by Forbes, “we’ve always done it this way,” could be death to any business. So if you’re still relying on paper timesheets, guesstimations, and the memories of your workers, you’re likely losing money.

If not, you are certainly at risk of non-compliance with the FLSA.

But staying profitable and compliant are just a couple of benefits of employee time tracking.

Bill Clients More Accurately

It’s hard to build your company when you’re billing based on inaccurate information. Tracking employee hours is how you get a clear picture of your labor costs. This, in turn, helps you bill more accurately.

Quickly Generate Payroll

Most modern, cloud-based time-tracking systems provide you with integration to help you run your payroll quickly - usually within minutes - by importing the time information from the app.

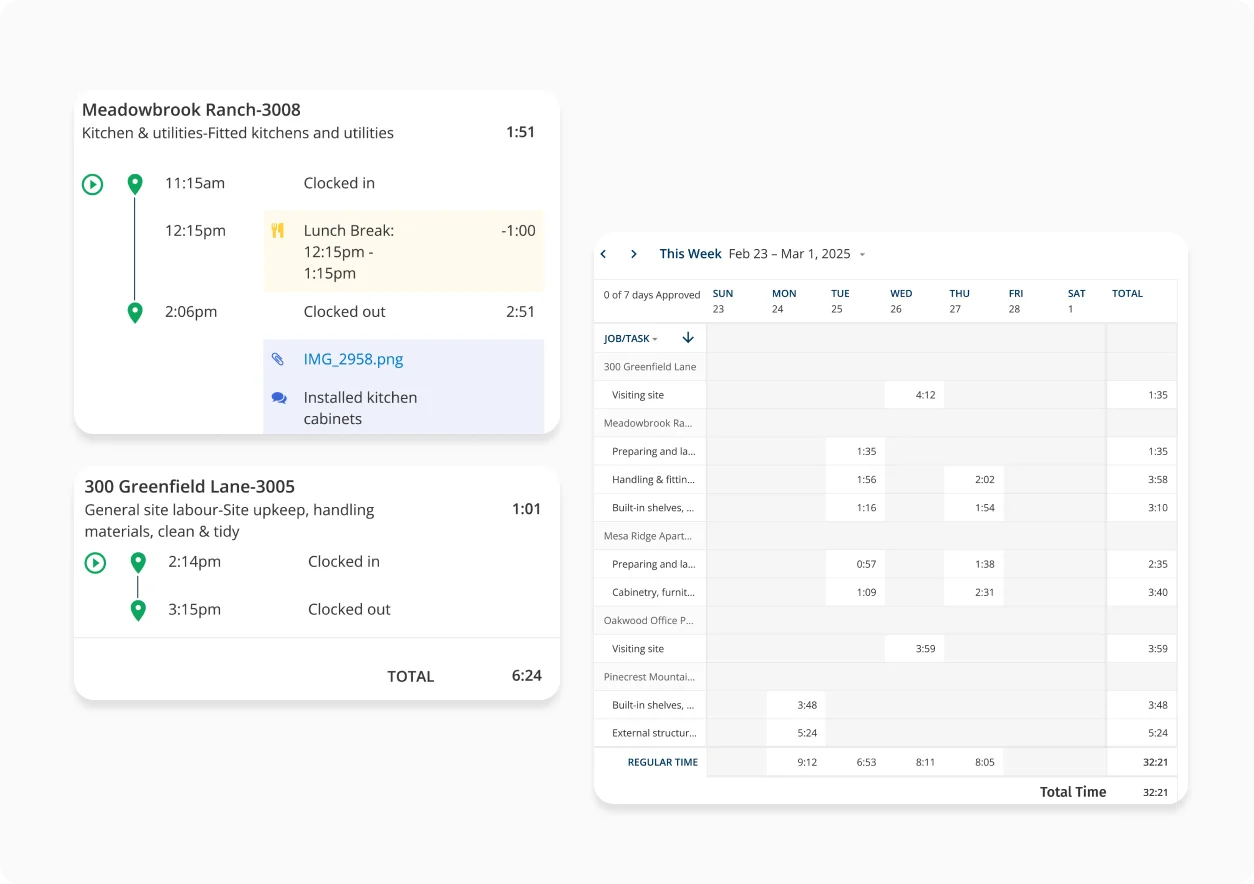

Better Project Management

With a mobile time-tracking app, you are always aware of where your crew is and doing what. This helps you manage your projects more efficiently than having to go to each worksite to determine where the project stands.

Monitors Productivity

When you can see who is working on which job and task, you’re better able to assign the right jobs and tasks to the right workers. While one employee might be a master at framing, another’s strength might be a demo. With detailed and accurate time tracking, you’ll see for yourself and be able to assign jobs accordingly.

Increase Transparency

When the team knows their times are being tracked, they’re more likely to be productive. Conversely, when their time is tracked, they can see for themselves, how many hours they have put in, and have an accurate estimate of how much their next paychecks will be.

Eliminate Timesheet Rounding

Timesheet rounding can cost your company money when abused. Plus, you can’t accurately track your labor costs. Automated employee time tracking removes this issue and gives you accurate labor data.