Employers have many responsibilities when it comes to payroll. Making accurate and regular payments to their employees, sending out tax forms by certain deadlines, paying taxes, and classifying employees correctly are just a few parts of a compliant payroll process.

Although payroll seems straightforward enough to an outsider, those who actually work in the department know that it can be complicated to manage payroll. Payroll errors are easy to make. Even the IRS admits nearly one-third of all businesses make payroll mistakes on an annual basis.

The consequences of payroll mistakes are far-reaching. Common payroll errors can result in severed relationships with your employees, loss of company money, inaccurate payroll records, and harm to the company’s good name and position.

In a worst-case scenario, the IRS may get involved and charge your company expensive fines. If you don’t know there’s been a mistake, it’s difficult to correct payroll errors, which leads to inaccurate payroll records.

Thankfully, the majority of common payroll mistakes can be categorized into one of 11 types. Read on to learn everything you need to know about avoiding costly payroll mistakes.

The 11 Most Common Payroll Errors to Avoid

1. Missing a Deadline

Missing a deadline to pay federal or state payroll taxes costs companies a lot of money in fees and interest. Employers are also required to pay their employees on a certain schedule, depending on the state. Paying too late or too infrequently can trigger penalties.

How to avoid it:

Look up your state’s payday requirements and automate your payroll to pay employees on the correct schedule. For payroll taxes, set a reminder on your schedule one month before the deadline (as well as on the date itself) so you can be prepared.

2. Overtime Miscalculation

It’s illegal not to pay nonexempt employees extra wages for overtime. Employees must be paid at least 1.5 times their regular pay rate for any overtime hours that are worked, according to the DOL’s regulations regarding overtime.

If an employer fails to pay an employee extra wages for the overtime they have worked, they can be held liable for paying back liquidated damages. Generally, this is equivalent to 2x the amount of back wages that are due. This will result in a hefty number of expensive fees for the company.

How to avoid it:

Automate your time tracking process by having your employees use a time-tracking software to log their hours in real-time. Managers can review and approve the timesheets to ensure that employees are not working through mandatory lunch breaks or punching off-site. Tracking this data will give you a timesheet report that makes it easy to see who has worked overtime and help you keep accurate records of employee hours.

3. Tax Issues

Taxes can be a complicated and overwhelming part of the payroll process because of payroll laws. You have a lot of balls to juggle: from sending out tax forms on time to making payroll tax deposits. According to the National Small Business Administration, payroll taxes create an arduous administrative burden for small businesses, with 63% of small businesses spending over $1,000 annually just on the administration costs of federal taxes.

How to avoid it:

Employers are required to send out tax forms every year to all their employees, including W2 employees and independent contractors. Mark your calendar for January 31st, and make sure that all your W2s and 1099s are postmarked by this date.

Payroll taxes are referred to by the IRS as employment taxes, and they include a FICA tax, federal income tax, & federal unemployment (FUTA) tax. Employers are generally required to pay quarterly.

Look up the deadlines for federal, state, and local payroll taxes. Depending on the amount of payroll taxes your company has owed historically, you may need to make monthly, semi-weekly, or next-day payroll tax deposits. Set a reminder for each payroll tax deadline, and automate your payroll, so you don’t even have to think about it.

Save Time and Money with ClockShark

4. Making an Incorrect Payment

There are a few reasons you may overpay or underpay your employees. Data entry mistakes occur when numbers are difficult to read, due to sloppy handwriting or damaged timesheets. If an employee is incorrectly classified, you may make incorrect deductions, withholding too much or too little from their paycheck.

Relying on paper timesheets makes it easy for employees to log incorrect hours, whether accidentally or on purpose. Even innocent rounding errors cost companies a fortune of extra pay.

How to avoid it:

Take steps to prevent timesheet fraud by having your employees submit their timesheets for approval, so managers can double-check the accuracy of each pay sheet. Using a GPS time clock allows companies to ensure that employees are really on the job site when they say they are, and this will reduce instances of timesheet rounding and buddy punching.

Payroll software helps you review and approve timesheets and ensures you’re getting accurate employee hours. Once your employees’ timesheets have been approved, export them directly to a payroll software to avoid data entry errors.

5. Forgetting About a Holiday

This payroll mistake seems obvious, but it’s easy to make. When a bank holiday falls on the same day as payday, your payroll may be late due to the bank being closed.

How to avoid it:

Most calendars are automatically synced with bank and national holidays. At the beginning of the year, go through your calendar and make a note of the holidays that will interfere with pay day.

6. Not Paying Frequently Enough

Companies are required to pay employees on either a weekly, bi-weekly, semi-monthly, or monthly basis, depending on their state’s payday requirements. Failure to comply with these regulations can get your company in trouble.

How to avoid it:

Check the laws regarding payday schedules for your state and build your own payday schedule around it. You are allowed to pay your employees more often than the regulations require, but not less often.

7. Incorrect classification

Misclassifying an employee as an independent contractor — or vice versa — can have detrimental effects on a company. An employer is required to withhold a portion of each employee’s paycheck to pay their federal income taxes, social security, Medicare, and unemployment taxes.

But they don’t have to withhold any of this from the paycheck of an independent contractor. This results in lower overhead for the employer, making contractors an attractive hiring choice. However, if a company is classifying individuals as contractors when they should be employees, the mistake can result in criminal penalties and a large number of expensive back tax payments.

How to avoid it:

Familiarize yourself with how the IRS defines the difference between an independent contractor and a full-time W2 employee.

8. Not Paying for Training

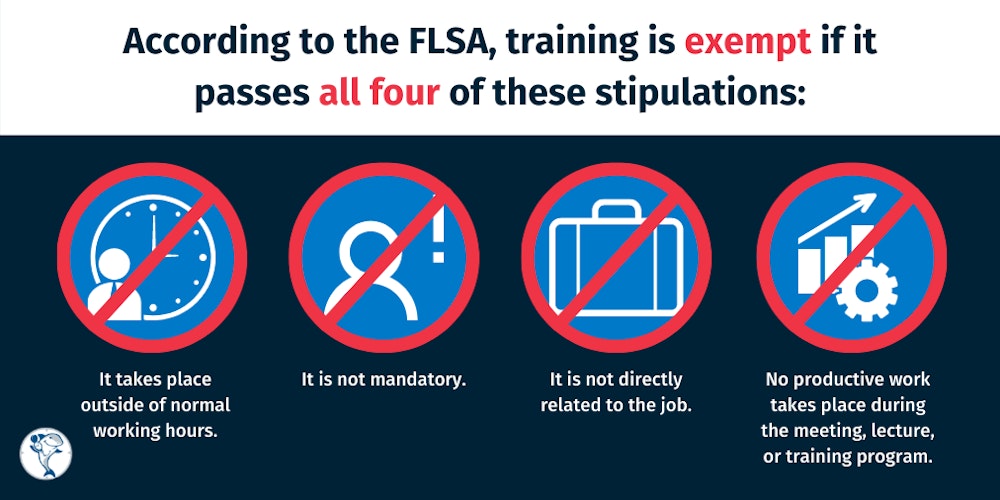

Did you know that employees have the right to be paid for work-related training? There are very rare cases where employers don’t have to compensate their staff for attending a training program. According to the Fair Labor Standards Act (FLSA), training is exempt if it passes all four of these stipulations:

- It takes place outside of normal working hours

- It is not mandatory

- It is not directly related to the job

- No productive work takes place during the meeting, lecture, or training program

How to avoid it:

Know that employees have the right to be paid for most job training programs. Have them punch in and punch out for these meetings, lectures, or programs just as they would for a regular work day.

9. Not Sending Out a 1099

According to the IRS, businesses must send a Form 1099-MISC to all independent contractors who were paid at least $600 during the previous fiscal year. This tax form must be sent to the contractor by January 31st, and it will generally need to be sent to the IRS by either February 28th or March 31st, depending on whether you are filing electronically or by mail.

Failing to issue a 1099 to your contractor can result in hefty penalties between $50-$550 for each missing form. There’s a cap of approximately $3 million in penalties for late forms, though if you disregard reminders to send in a missing form, the cap is lifted completely.

How to avoid it:

Have all independent contractors complete a Form W-9 at the beginning of their contract. Send the same W-9 form to all your existing contractors at the beginning of every year so you are sure to have their updated information on file.

This form will give you all the information you need to file a 1099 form, so you don’t have to worry about tracking down contractors in the middle of tax season.

You can use your accounting software to track payments to vendors and contractors throughout the year. Remember that any contractors who receive at least $600 in payments will need to be issued a 1099.

10. Errors in Data Entry or Records

Data entry errors are easy to make, especially when companies rely on paper systems. If an employee hands in a sloppily written timesheet, you may misrecord their hours. This can result in an overpayment, costing the company money, or an underpayment that triggers penalties and fines.

Other common errors include failing to update your business address or recording an incorrect Social Security number for an employee.

How to avoid it:

Verify the social security numbers of new hires through the Social Security Number Verification Service. If you’ve never done this before, you can upload your entire payroll at one time and receive verification within one business day.

You can also greatly reduce the number of data entry errors by integrating your timekeeping and payroll software. Employees clock in and out from their phones, and the information is sent straight to your accounting software, eliminating the confusion and inefficiency of paper time sheets and the risk of data entry errors.

11. Not Staying Up to Date With Changes to the Law

Last but not least, payroll rules and regulations are always subject to change. For example, in September of 2019 the DOL announced a new overtime regulation that increased certain salary levels, making more workers eligible for overtime pay. The law went into effect on January 1, 2020. If a company was not in the loop about this change, they could easily fall out of compliance without realizing it.

How to avoid it:

Check the DOL’s website regularly, and sign up for their email list to receive instant alerts about new legislation. Check your state or county website for an email list, as well, to stay up-to-date on local regulations.

Does your company have employees across state lines, or do you work with international employees? Keep a tab on any new policies in those states and countries, and be sure to consult an attorney if there is any confusion about how the regulations will affect your workers.

You should also make it a habit to regularly attend industry events and network with other HR professionals. A good resource for HR professionals is the human resources management website HR.BLR.

If your company has a contract with an employment law attorney, pay attention to any email updates regarding federal legislation. Take some time to build a relationship with your attorney so they will have a better idea of what rules and regulations will affect your employees.

Fix Payroll Mistakes With Automation

According to the American Payroll Association, companies that integrate their timekeeping and payroll functions are 44% more likely to avoid common payroll errors and enjoy a rate of payroll mistakes that stays below 2.01%.

Integrating timekeeping and payroll software produces a smoother experience for employees, which can improve retention rates plus it streamlines your payroll process saving you time and money.