Contractors and subcontractors have a lot to stay on top of when it comes to compliance. For publicly-funded projects, certified payroll is yet another compliance-heavy burden.

It’s a very data-heavy, time-consuming process but, to stay competitive and compliant, you need to understand certified payroll.

Nick Foucault, Director of Points North who assists contractors with certified payroll, has been helping contractors for a decade with the complicated process.

Foucault says contractors and subcontractors need to understand certified payroll because, essentially, you need it to get paid.

“If you are in the government-funded construction space, compliance is critical. If you do not do the type of reporting that’s necessary you can be at risk for, basically, not getting paid.”

What Is Certified Payroll?

Certified Payroll is a specialized weekly payroll process that contractors are required to use when doing publicly-funded federal and military projects.

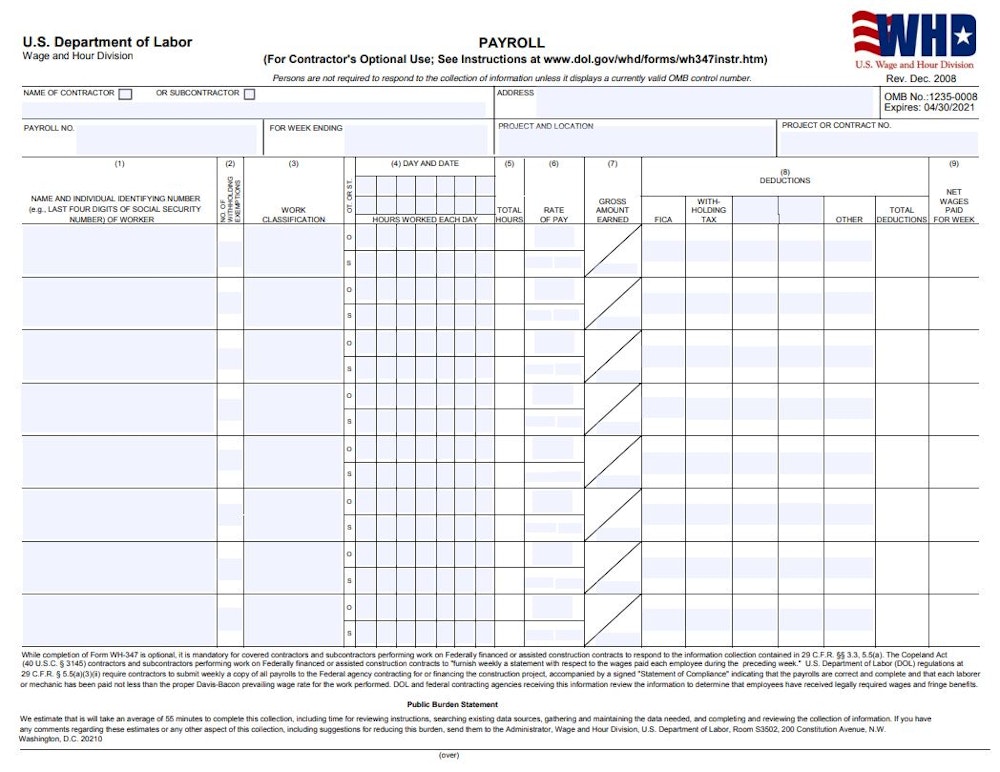

They must complete and submit federal form WH-347 to the supervising entity that is overseeing the government project. While it is a federal requirement, many states have additional requirements rooted in the Davis Bacon Act of 1931.

The Davis-Bacon Act

Named after the Act’s sponsors - PA senator James Davis and Secretary of Labor Robert Bacon - the Davis-Bacon Act (DBA) was passed and signed into law in 1931. The intention of the act was to protect workers from being underpaid and working in unfair conditions.

Bacon had attempted to craft the bill 13 times before it was passed in an effort to address worker conditions, protect local workers from being displaced by migrant workers, and “avoid competitive pressure toward lower wages,” according to experts.

It has been amended many times throughout the years and additional legislation has expanded the scope of the DBA with Acts such as the Copeland Anti-Kickback Act, Contract Work Hours and Safety Standards Act, the Walsh-Healey Public Contractors Act, and many more.

Today, the DBA applies to “contractors and subcontractors performing on federally funded or assisted contracts in excess of $2,000 for the construction, alteration, or repair (including painting and decorating) of public buildings or public works.”

These jobs can include:

- Plumbers

- Carpenters

- Masons

- Concrete work

- Electricians

- Insulation

- Laborers

- Lathers

- Painters

- Power equipment operators

- Roofers

- Sheet metal workers

- Truck Drivers

- Welders

The DBA has been largely supported in Congress as well as among industry leaders who say it prevents “competition from ‘fly-by-night’ firms that undercut local wages and working conditions and compete, unfairly, with local contractors for federal work” but not everyone agrees.

Opponents argue that the DBA is no longer needed due to “market changes and enactment of other federal labor standards laws — notably, the Fair Labor Standards Act of 1938,” among other things.

Regardless of where you stand on the subject, it’s a requirement for any contractor or subcontractor who is performing government contracts. It is the foundation of the prevailing wage law.

Prevailing Wage Law

The DBA provides that all workers covered by the Act be paid according to prevailing wage laws. Since different jobs pay different amounts in different locales (usually designated as counties), the Prevailing Wage Law takes into account the wages of the local economy.

The wages are determined by surveys conducted by the U.S. Labor Department that collect information on how much different occupations are paid in nearby areas. Contractors working on a federally-funded project must abide by prevailing wage determination (WD) and the Department of Labor’s Wage and Hour Division (WHD) determines locally prevailing wage. This includes fringe benefits as well.

Foucault says understanding prevailing wages is an aspect that’s critical to proper certified payroll reporting.

“You have to get the employees paid properly...but also the reporting that corresponds to what happened that pay period that shows you did adhere to the proper payroll requirements that they laid out for the job.”

What Is Federal Form WH-347?

If you have a government contract project that applies to the DBA, you won’t get paid without filling out federal form WH-347.

WH-347 is a Payroll form that must be filled out and submitted weekly and is “mandatory for covered contractors and subcontractors performing work on Federally financed or assisted construction contracts.”

According to the WHD, “it will take an average of 55 minutes to complete this collection of information, including time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information.”

However, Foucault warns this is just an average.

“In our experience, it typically takes much longer than what the agencies are describing because if you have no process and no technology to help with this - and time tracking technology is a huge piece of that - you still have to find some way of getting all the data understood.”

The DBA is a highly complex piece of legislation that includes certain exemptions such as workers who own a certain percentage of the company doing the work. It’s important that you become familiar with the laws and regulations - including local or state laws - and consider becoming a Certified Payroll Professional (CPP) according to the standards and requirements of the American Payroll Association.

“Without a system or, actually, a variety of systems, to track that data, you’re going to be spending a lot more time than an hour per report, every week, trying to sit down and figure this all out.”

Alternatively, you can enlist the help of experts like Foucault who can simplify the process for you.

Who Needs to Submit Certified Payroll

Generally, any employer who has laborers or mechanics working on a federal project will need to submit certified payroll. In some cases, there may be exemptions so you need to familiarize yourself with the laws.

What Makes the Payroll Report “Certified”?

The WH-347 Payroll form is an official statement of compliance that must be signed by the contractor, subcontractor, or the person responsible for the supervising of payroll.

It is a very detailed report and any mistakes or errors - whether intentional or accidental - can lead to severe penalties. Foucault says some states require additional or different types of reports so you should check with state requirements.

How to Complete the Certified Payroll Report Manually

The Department of Labor offers extensive instructions on how to fill out your certified payroll report manually. The information you will need includes:

- Company name and whether you are a contractor or sub

- Company address

- Payroll number (beginning with #1)

- For week ending (date)

- Project name and location

- Employees’ names and employee number

- Number of withholding exemptions

- Work classifications

- Hours worked

- Rate of pay

- Gross amount earned

- Deductions

- Net amount of pay

- Descriptions of any deductions

- Descriptions of fringe benefits

- Exceptions

To submit the form manually, you can download the pdf provided by the DoL and simply handwrite the information or use a pdf editing software to enter it with your computer.

Common Mistakes To Avoid When Filing Certified Payroll Reports

Foucault says they see a variety of mistakes when it comes to certified payroll. The most common being just not understanding the data necessary to provide accurate, proper reports.

“One of the most common mistakes is not having the data properly understood before you sit down to fill it out. Properly tracking data is critical to having your certified payroll report done correctly.”

Foucault explains that, often, they will see clients who say they are prepared to do the reporting but they actually aren’t.

“People have their payments for their work on the job held up until reporting is done properly. People don’t do the reporting… [they] think they don’t have to or they don’t want to...or they’ll use their own form.”

Paying the correct prevailing wages is also a frequent issue because, sometimes, people don’t find the correct wages to pay.

“If you take on one of these jobs, you have to pay these prevailing wages which comes with the contract of the project. What people will sometimes do is kind of guess or they’ll Google it which could result in paying the completely incorrect wages.”

Another common mistake is not having the data properly tracked. Technology, he says, is an incredibly powerful way to prevent this - and many other - common mistakes.

While most of the mistakes are not malicious, Foucault says they lead to delays in payments and can become audit nightmares.

What Are The Penalties

In 2015, Jeffrey John Plzak who ran Honda Electric with his spouse in Minnesota, was sentenced to 22 months in prison and ordered to pay over $240,000 in restitution for falsifying information on certified payroll reports.

It was a highly publicized case that was the result of an investigation by the FBI and Minnesota Department of Transportation’s Labor Compliance Unit.

“That’s an extreme example but certainly a reality if you do anything with this data that’s, in any way, falsified.”

Penalties can range from fines and imprisonment to being disbarred from ever being able to work on publicly-funded projects again.

Tips For Contractors & Subcontractors for Certified Payroll

Foucault says the greatest thing contractors and subcontractors can do for themselves and their employees is to adopt technology.

“Technology is the best practice as far as getting certainty that you produce exactly what you need when you need it to be compliant and get paid for the work you’re taking on.”

Points North uses the data collected through mobile time-tracking app to keep the information properly stored and to fill out certified payroll reports accurately and properly.

“The requirements around certified payroll reporting involve very specific data elements,” Foucault says. “We are allowing clients to use their ClockShark data and we can load that data into our solution.”

The process makes certified payroll much more simple and far more accurate so you don’t have to worry about mistakes or incorrect data. Since ClockShark allows your workers to switch tasks - say, from general labor to painting - you have accurate records that reflect which jobs were done on which day with the correct classifications.

Points North is a leader in certified payroll with their compliance, reporting, and data aggregation solutions that help payroll and human resource leaders solve data issues. Reach out to them today for more information.

ClockShark is the number one mobile time tracking app for construction and field service companies that helps you collect the right data to run proper certified payroll reports. Try ClockShark free for 14 days or contact our five-star customer support for more information.