The U.S. Chamber of Commerce explains that many small businesses choose to do their own bookkeeping and accounting but it requires extraordinary organizational skills. After all, it’s tough to keep records, receipts, invoices, job costs, payroll, material costs, and everything else organized when you’re trying to run a business.

According to research, 82 percent of companies fail due to cash flow problems. Construction has the lowest level of survival rate, with 75 percent failing within the first year and 40 percent failing by the fifth.

As a contractor, understanding and optimizing your pay rates is crucial for profitability. When using ClockShark, you get accurate pay rate information and can run detailed reports based on the information collected, to help you keep track of how much you’re spending on labor.

Understanding contractor pay rate reports: What are they?

Contractor pay rate reports show how much contractors get paid for the work they do. It includes details like the project your team worked on, how much they're paid per hour or day, and how many hours they worked.

Pay rate reports enable construction and field service businesses to make informed decisions about labor costs, resource allocation, and project planning. By utilizing these insights, you can enhance profitability by reducing costs and making data-driven decisions that positively impact the bottom line.

How pay rate reports enhance profitability

Pay rate reports play a significant role in enhancing profitability by providing insights into labor costs and aiding decision-making. They show how much is spent on labor for different projects, so you can decide how many people are needed for each job, so there's no wasted time or money.

Additionally, pay rate reports help you perform job costing more accurately and profitably by being able to reference the true cost of labor for previous, similar jobs. This keeps you from over- or under-bidding jobs. You can also compare previous hours spent on similar jobs with other employees to determine if there might be a need to evaluate your workers.

While it won’t help you calculate the true labor burden for each employee, you will have a solid, accurate report of how much the jobs are costing you in direct labor. Since the pay rate report shows details on regular, overtime, and double-time pay, you’ll have a clear and accurate picture of your labor costs.

These reports serve as crucial tools for construction companies, contractors, and project managers to manage their labor costs, maintain compliance with labor laws, and ensure accurate financial record-keeping. By using these reports, companies can make better plans, negotiate better prices, and make more profit on their projects.

How ClockShark streamlines pay rate reporting

Creating and running ClockShark pay rate reports is simple. You can easily generate reports and get an overview of how much labor was spent on any specific job, task, or crew member. These reports will help you:

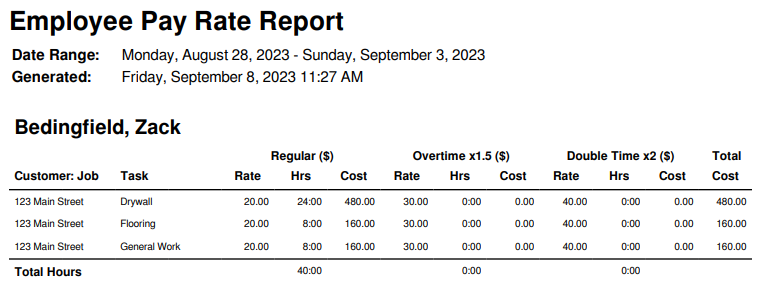

1. Track hourly rate

Determine the labor costs for each subcontractor or employee for any specific project they worked on. Track any regular time, overtime, or double time.

2. Track billable hours

Add in the rate at which you will be billing your customer for each working hour. Then, run the pay rate report by job and get the total labor amount needed to bill the customer.

3. Run reports by subcontractor/employee

Get a breakdown of the labor costs for each team member.

4. Run reports by jobs

Get a breakdown of the labor costs for any specific job your team worked on.

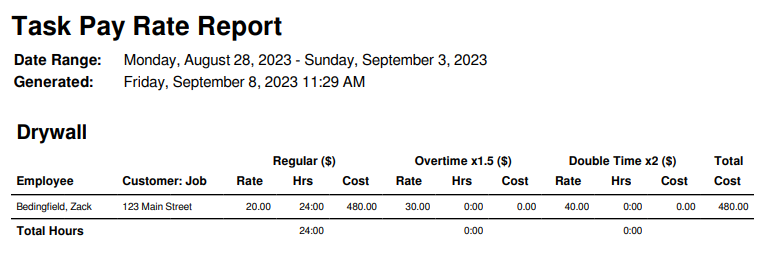

5. Run reports by tasks

Get a breakdown of the labor costs for any specific task they performed while on the job.

Being able to see pay rate reports over a period of time can help you accurately predict what payroll is going to cost your business. With these reports, you can use the data created and tracked in ClockShark to make important business decisions and enhance your profitability.

Running a pay rate report in ClockShark

This is how to run a Pay Rate Report to stay on top of your labor costs:

→ Navigate to the reports menu item on your dashboard

→ Click pay rate on the dropdown menu

→ On the left side, navigate to financial

→ Select the date range you wish to view

→ Choose whether to group by employee, job, or task

→ Select individual employee(s), job(s), or task(s) if you don’t choose to include all.

→ Download the report in your preferred format (PDF or CV)

Save Time and Money with ClockShark

Embracing technology for profitable pay rate management

Using ClockShark’s Pay Rate Reports will help you find the strengths in your labor costs and identify potential areas for improvement so you can nail your job costing and estimate for future jobs and make payroll and tax time much simpler and more accurate.

Try ClockShark free for 14 days and start keeping track of how much you’re spending on labor.