In business, timesheet rounding is a common practice that helps simplify payroll calculations.

While it's widely used, it's also governed by a complex set of regulations. Missteps in timesheet rounding can result in compliance issues, labor disputes, or financial penalties. For this reason, it's crucial for employers and human resource professionals to understand the practical and legal aspects of timesheet rounding.

What is time clock rounding?

Time clock rounding refers to the practice of rounding employee timesheet hours to the nearest 5, 10, 15, or other minute interval. For example, if an employee clocks in at 8:07 a.m., the time may be rounded to 8:10 a.m. If they clock out at 5:13 p.m., it may be rounded to 5:15 p.m.

The intention behind rounding is to simplify payroll processing. Rather than calculating exact punches down to the minute, employers can round to the nearest interval. This prevents excessive coding of minute variances in payroll systems.

Is time clock rounding legal?

Time clock rounding is legal if done properly. The Fair Labor Standards Act (FLSA) allows rounding as long as it does not consistently underpay employees over time. Both rounding up and down is permitted.

For example, an employer can round the 8:07 AM punch to 8:00 AM and the 5:13 PM punch to 5:15 PM. While the employee was shorted 7 minutes in the morning, they gained 2 minutes in the evening. Over time, slight variances even out so employees are paid for all hours worked.

Illegal rounding would be adjusting every clock in/out to the employer's advantage. Consistently rounding up clock-ins and down clock-outs underpays employees over the long run.

Although time clock rounding is legal, lawsuits against employers who practice timesheet rounding are frequently won by the employees who bring them to court. Employers who are shown to be non-compliant are ordered to pay for unpaid overtime or minimum wages, plus liquidated damages “equal to the amount of unpaid overtime or minimum wages.”

You may also be required to pay attorneys’ fees and costs and, if the non-compliance is found to be deliberate, you may face additional civil and criminal charges.

Why do employers round timesheets?

Employers who practice time clock rounding are usually trying to keep their payroll process simple. Rather than paying to the minute for hours worked, calculating payroll in 15-minute intervals, for example, makes it easier to calculate.

How do employees feel about timesheet rounding?

Many employees have mixed feelings about timesheet rounding policies. Some employees see timesheet rounding as a convenient way to quickly log their time without worrying about minor discrepancies. However, other employees view rounding as unfair, feeling that they are not getting fully compensated for all the time worked.

Timesheet rounding can frustrate some employees who feel they are donating free work minutes. For instance, an employee who regularly clocks in at 8:05 a.m. and clocks out at 5:10 p.m. will always have 5 minutes rounded off each day. Over a year, those minutes can add up to several hours of unpaid work time.

What to keep in mind when rounding work hours

There are three basic rules of timesheet rounding according to the Department of Labor.

- Timesheet rounding cannot favor the employer: If you most often round your employees’ timesheets to benefit your business, you are likely breaking the law.

- The maximum amount of time that can be rounded to is 15 minutes: While you can choose to round to the nearest five or 10-minute mark, 15 minutes is the maximum.

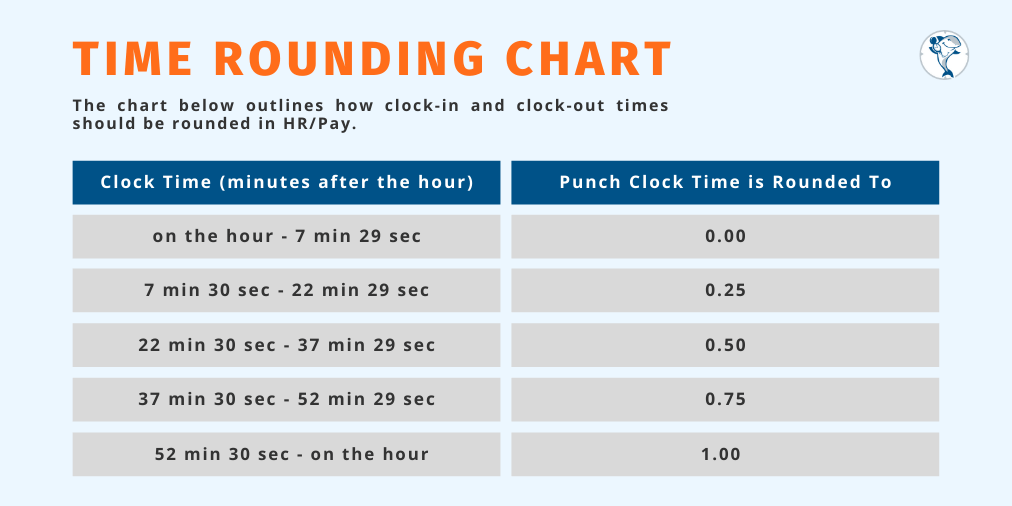

- Employers must honor the 7-minute rule: You must always round timesheets according to the 7-minute rule. Use a timesheet rounding chart to get a better idea of how the 7-minute rule works.

Consequences of improper timesheet rounding

While timesheet rounding may make payroll easier, it doesn’t come without consequences and risks.

Unpaid Work

For many employers, workers are not allowed to clock in until their shift, but they will still work. This is a clear violation of the FLSA laws and can lead to hefty fines.

Inaccurate Timesheet Data

Increasingly, data is important to today’s global workforce. Not only does accurate timesheet data mean your employees receive accurate pay, but you also have a clear picture of things like job costs and a visualization of how your company is running. The Department of Labor requires you to keep a minimum of three years of specific records for each employee, including total hours worked each week.

De Minimus Work

The De Minimus Doctrine dictates the law can’t worry about “trifling” things such as a minute or two here and there of work not paid for. But these unpaid minutes can add up and result in penalties through the courts.

A specific example is Troester v. Starbucks, where an employee was required to clock out before closing the store. The procedure for closing the store would take varying amounts of time as Troester would send sales and inventory reports, and profit and loss statements, activate the store alarm, bring in patio furniture left outside, escort employees to their vehicles, and more.

The California Supreme Court ruled in Troester’s favor that the De Minimus Doctrine did not apply and that Starbucks had violated California and Federal laws.

How to stop timesheet rounding

To avoid risking non-compliance for your payroll, the best practice is to eliminate timesheet rounding altogether. But, how can you eliminate timesheet rounding and still pay your employees accurately?

The answer is: Automated time tracking. There are multiple benefits to using a time-tracking software and eliminating timesheet rounding is only one of them.

1. Improved employee experience

A time-tracking solution that provides employees with the option to clock in and out from their mobile devices and computers makes time tracking easier for them. They can view their timesheets at any time, so they are clear about what to expect on their next paycheck, and they can rest assured knowing they will be paid the right amount for exactly the hours they worked.

2. Increased time to tackle new projects

When your payroll administrators don’t have to spend hours combing through timesheets and time records, they’re able to focus on other projects. This will increase their productivity, too.

3. Ensured compliance with federal law

Payroll rules and regulations are strict and the penalties for not following them can be debilitating. Accurate timesheets ensure accurate pay for your employees. This translates into State and Federal law compliance.