The Coronavirus is deeply impacting businesses across the globe. Some research shows that almost 90 percent of field service companies are either restricting or eliminating on-site deployments.

The federal government advises that people work or go to school from home when possible for at least the next 30 days to maintain social distancing and help curb the spread of COVID-19.

Remote work technology and cloud-based solutions have been adopted by many companies that may have never used them before. According to research , some of the responses of large companies to the coronavirus include:

- Work from home policies

- Closing stores/stopping services

- Stacking shifts

- Paid sick leave

- Adjusting hours of operations

Among other things. For companies that cannot afford paid sick leave, the government has stepped in.

What Is The FFCRA?

Not all employees are essential and not all companies can afford to give employees paid time off . That's why the federal government established the Families First Coronavirus Response Act (FFCRA) to help both workers and employers who meet specific criteria.

The FFCRA is meant to reduce the economic impact of COVID-19 for certain American private companies during the Coronavirus pandemic .

It specifically helps private employers that have less than 500 employees. Tax credits for the cost of providing their employees with paid leave taken for Coronavirus-related issues will be given to qualifying companies.

Which Employers Must Provide Paid Leave?

This Act applies to most companies with less than 500 employees.

However, there is an exemption available for some small businesses with fewer than 50 employees. According to the DoL :

“An employer, including a religious or nonprofit organization, with fewer than 50 employees (small business) is exempt from providing (a) paid sick leave due to school or place of care closures or child care provider unavailability for COVID-19 related reasons and (b) expanded family and medical leave due to school or place of care closures or child care provider unavailability for COVID-19 related reasons when doing so would jeopardize the viability of the small business as a going concern. A small business may claim this exemption if an authorized officer of the business has determined that: The provision of paid sick leave or expanded family and medical leave would result in the small business’s expenses and financial obligations exceeding available business revenues and cause the small business to cease operating at a minimal capacity; The absence of the employee or employees requesting paid sick leave or expanded family and medical leave would entail a substantial risk to the financial health or operational capabilities of the small business because of their specialized skills, knowledge of the business, or responsibilities; or There are not sufficient workers who are able, willing, and qualified, and who will be available at the time and place needed, to perform the labor or services provided by the employee or employees requesting paid sick leave or expanded family and medical leave, and these labor or services are needed for the small business to operate at a minimal capacity.”

How Does The New Paid Sick Leave Work?

Since the new FFCRA passed into law, the Department of Labor has updated the FAQ regarding the Act so it’s important that employers review the information regularly to make sure they stay compliant.

Here is the most current information available for employers and employees regarding the FFCRA.

What Are The Benefits of FFCRA?

The FFCRA was adopted as an extension of the 1993 Family and Medical Leave Act to provide additional protection for employees who meet certain criteria. It provides these employees with paid sick leave through the Emergency Family and Medical Leave Expansion Act (EFMLE) and the Emergency Paid Sick Leave Act (EPSLA).

Private sector employers that provide paid sick leave and expanded family and medical leave required by the FFCRA are eligible for reimbursement of the costs of that leave through refundable tax credits.

Who Is Eligible?

The rule applies to the definition of employees according to the Fair Labor Standards Act and includes full-time, part-time, “joint employees” working on your site temporarily and/or through a temp agency.

What Are The Qualifying Reasons For Paid Leave?

The FFCRA applies to COVID-19 issues for employees who cannot work from home. If the employee:

- Is quarantined due to federal, state, or local requirements

- Has been told by a qualified healthcare provider to self-isolate

- Is having COVID-19 symptoms

- Is caring for someone who is self-isolating due to medical or legal orders

- Is caring for their child because COVID-19 closed down available childcare resources/schools

Is “experiencing any other substantially-similar condition specified by the Secretary of Health and Human Services, in consultation with the Secretaries of Labor and Treasury.”

How Many Days Do I Have to Provide?

According to the DoL, you must provide up to two weeks (80 hours, or a part-time employee’s two-week equivalent) of paid sick leave based on the higher of their regular rate of pay, or the applicable state or federal minimum wage, paid at:

- 100 percent up to $511 daily and $5,110 total if:

- They are subject to a Federal, State, or local quarantine or isolation order related to COVID-19, have been advised by a health care provider to self-quarantine related to COVID-19, or are experiencing COVID-19 symptoms and is seeking a medical diagnosis.

- 2/3 for qualifying reasons #4 and 6 below, up to $200 daily and $2,000 total if:

- They are caring for an individual or self-quarantine that is COVID-19 related

- Up to 12 weeks of paid sick leave and expanded family and medical leave paid at 2/3 for up to $200 daily and $12,000 total if:

- They are caring for their child whose school or place of care is closed (or child care provider is unavailable) due to COVID-19 related reasons

A part-time employee is eligible for leave for the number of hours they are normally scheduled to work over that period.

Do I Have to Give Employees Their Regular Pay Rate?

The DoL advises:

Employees taking sick leave for COVID-19 related reasons, receive for each applicable hour the greater of:

- Their regular rate of pay,

- The federal minimum wage in effect under the FLSA, or

- The applicable State or local minimum wage.

They are “entitled to a maximum of $511 per day, or $5,110 total over the entire paid sick leave period.”

If they are “taking paid sick leave because they are: (1) caring for an individual who is subject to a Federal, State, or local quarantine or isolation order related to COVID-19 or an individual who has been advised by a health care provider to self-quarantine due to concerns related to COVID-19; (2) caring for your child whose school or place of care is closed, or child care provider is unavailable, due to COVID-19 related reasons; or (3) experiencing any other substantially-similar condition that may arise, as specified by the Secretary of Health and Human Services, they are entitled to compensation at 2/3 of the greater of the amounts above.”

Under these circumstances, they are subject to a maximum of $200 per day, or $2,000 over the entire two-week period.

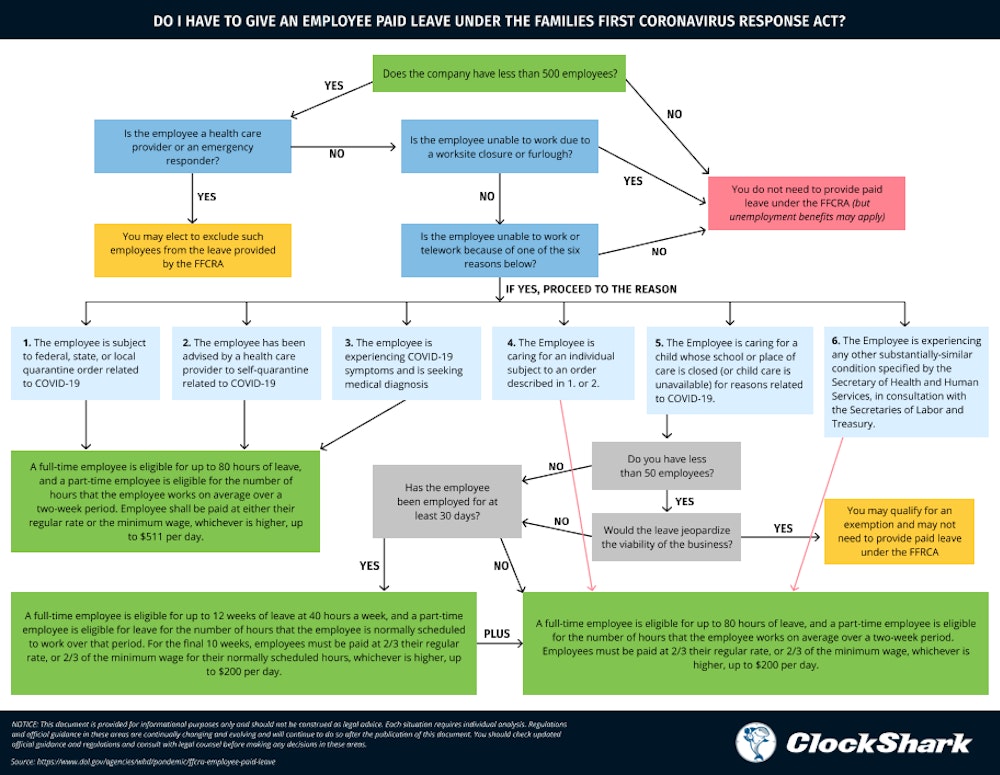

Download This FFCRA Chart

What Documents Should My Employees Provide To Receive Paid Sick Leave Under The FFCRA?

Employers who are providing paid sick leave will need to have supporting documentation when applying for the tax credit.

Your employees should also provide you with supporting documents for their leave such as:

*“A notice that has been posted on a government, school, or daycare website, or published in a newspaper, or an email from an employee or official of the school, place of care, or child care provider.”*

At this time, the Department of Labor suggests companies keep documentation to support their eligibility for the small-business exemption but they ask that you not send in any information until they release more details about the criteria for this exemption.

The IRS suggests:

You can “substantiate eligibility for the sick leave or family leave credits if the employer receives a written request for such leave from the employee in which the employee provides:

- The employee’s name;

- The date or dates for which leave is requested;

- A statement of the COVID-19 related reason the employee is requesting leave and written support for such reason; and

- A statement that the employee is unable to work, including by means of telework, for such reason.

*“In the case of a leave request based on a quarantine order or self-quarantine advice, the statement from the employee should include the name of the governmental entity ordering quarantine or the name of the health care professional advising self-quarantine, and, if the person subject to quarantine or advised to self-quarantine is not the employee, that person’s name and relation to the employee. In the case of a leave request based on a school closing or child care provider unavailability, the statement from the employee should include the name and age of the child (or children) to be cared for, the name of the school that has closed or place of care that is unavailable, and a representation that no other person will be providing care for the child during the period for which the employee is receiving family medical leave and, with respect to the employee’s inability to work or telework because of a need to provide care for a child older than fourteen during daylight hours, a statement that special circumstances exist requiring the employee to provide care.” *

What Are Employers Entitled to For Providing Paid Sick Leave Benefits?

According to the Internal Revenue Service, “the FFCRA provides businesses with tax credits to cover certain costs of providing employees with required paid sick leave and expanded family and medical leave for reasons related to COVID-19, from April 1, 2020, through December 31, 2020”

They say the tax credit will reimburse employers dollar-for-dollar, for the cost of providing paid sick and family leave wages to their employees for leave related to COVID-19.

What Timeframe Are Employees Entitled to Paid Sick Leave?

After the FFCRA was signed into law, it took effect on April 1, 2020 and is scheduled to expire December 31, 2020. It is not retroactive.

We want you and your employees to be safe and feel secure during this tumultuous time. Be sure you have the official DoL poster in a clearly-visible location for your employees and check their FAQ regularly so you can stay up-to-date on Federal requirements.