Growing your field service business is exciting! It opens up more jobs and more significant projects and is a healthy sign that your business is on the right track. When your business grows, it’s easier to see the weak spots in your processes and budget. It’s frustrating at first, but it provides an opportunity to improve things that might have been hard to notice with a small business.

Let’s be honest: effective payroll and time-tracking can make or break a team. It’s challenging to keep track of crew member hours and how to calculate hours worked, especially with varied kinds of rates and the movement of field service jobs. Mistakes in this process can cost you money and crew members' trust in your business.

It’s vital to get this right: money is the core of business, and your team members will want to be paid fairly and on time. And you want to ensure that reported work hours are accurate and consistent. It builds trust between you and your crew members to have effective communication and reliable processes, which means everyone can focus on their work rather than worrying about pay.

This article will help you understand what worked hours are, how to calculate hours worked, and tips and strategies to effectively manage crew payroll and time-tracking.

Defining Work Hours

To effectively monitor crew hours and learn how to calculate hours worked, it’s important to know what ‘worked hours’ are and the different categories of work hours that crew members can report.

Let’s break down the types of hours and explore each one.

Crew Member Worked Hours

The first step to tracking crew hours and calculating hours worked is to understand what needs to be calculated. So, what are ‘work hours,’ exactly?

According to the United States Department of Labor, work hours are defined as:

“[The] time an employee must be on duty, on the premises, or at any other prescribed place of work.”

Work hours are the hours a team member spends working in their role and on jobs under their purview. What your crew is hired to do and the time they’re given is important, as it can affect their pay rates.

There are three types of worked hours:

- Full-time

- Part-time

- Overtime

1. Full-Time

The definition of full-time working hours can be tricky because it may be different for each business. The maximum number of hours that is considered to be full-time will affect both part-time and overtime.

The Fair Labor Standards Act, also known as FLSA, establishes the maximum hours team members can work before they go into overtime. They currently have set the full-time limit to 40 hours per week. However, some businesses choose to set their maximum full-time hours lower than 40 hours. Again, this depends on your field service business and what crew members are expected to do.

2. Part-Time

If you have set a full-time job at 40 hours per week, part-time is anything less than that. You can put it as low as 16 hours or as high as 39 hours. However, it’s common for companies to set their part-time hours anywhere between 20-28 hours.

It’s recommended that you don’t push the limit of ‘part-time’ hours, such as setting part-time as 39. This can affect payroll, benefits and crew retention if hours fall into full-time without the positives. As with many things in construction and field service, it’s better to have a margin to allow for unknowns.

3. Overtime

Team members work for their regular pay when they work within the designated full-time work hours. When employees work past their maximum full-time hours, a.k.a. overtime, employers must compensate them more than their regular pay.

Typically, the standard overtime rate is 1.5 times the crew members’ hourly pay rate or time-and-a-half. Overtime must be added to the gross pay during payroll calculations.

For example, If an employee’s regular hourly pay rate is $25, their overtime rate would be $37.5 ($25 x 1.5 = $37.5).

Save Time and Money with ClockShark

Step-by-Step Guide On How to Calculate Hours Worked and Payroll

Tracking team hours is one thing, but payroll is a whole other ball game. As we stated at the beginning of this article, incorrectly calculating payroll hours can cost your field service business time, money and crew member trust.

We’ll take a look at how to calculate work hours with a few simple formulas that are no more complicated than the ones you use in your field servicing!

Below, we have explained the two steps we believe will get you on the right track to calculating hours worked and payroll.

1. Convert Time to Military Hours

Unlike the standard one to twelve “a.m.” and “p.m.” time, military time consists of a 24-hour clock. Converting time to military time is an important step when learning how to calculate hours worked, as it removes the confusion of mislabelled hours with “a.m.” or “p.m.”. The 24-hour format also means you’re able to distinguish hours more easily.

So, what does military time look like, and how do you convert standard time to military time?

Converting to Military Time

It can be tricky at first to adapt to military time, but the process itself is simple.

To get military time, all you need to do is add 12 to the times ranging between 1 PM and 11:59 PM. Instead of “p.m.”, think “add 12”. All a.m. times remain the same.

For example:

4:00 AM = 4:00

8:30 AM = 8:30

11:15 AM = 11:15

1:00 PM = 13:00

3:30 PM = 15:30

5:15 PM = 17:15

9:00 PM = 21:00

11:30 PM = 23:30

How to Calculate Hours Worked in Military Time

Now that you have the process of converting to military time, it’s time to calculate team member hours using it. We’ll use the example of ‘John’ and his workday to demonstrate how to calculate hours worked.

To start, log the starting and ending hours.

- John starts his workday at 8:30 a.m., which is 08:30 hours in military time.

- John ends his workday day at 4:30 p.m., which is 16:30 hours in military time.

Therefore, John’s hours were 8:30 to 16:30 in military time format.

Next, to calculate hours worked for payroll, use the difference between the hours. To calculate this difference, all you need to do is deduct the starting hours from the ending hours.

Using this example with John’s hours :

16.30 - 08.30 = 8

Therefore, John worked 8 hours during that specific workday.

2. Convert Hours to Decimal Value

After you have converted all times to military hours, the next step is to convert the hours into decimal values. Doing this will allow you to determine gross pay for your team members easily.

So, how do you use this to calculate payroll? We’ll use ‘Carlos’ and his working hours as an example.

- Carlos clocks in for his workday at 7:27 a.m., which is 07:27 hours in military time.

- Carlos clocks out of his workday at 2:49 p.m., which is 14:49 hours in military time.

When calculating the number of hours he worked for the day, remember we must find the difference using the military time.

14.49 - 07.27 = 7.22, therefore, Carlos worked 7 hours and 22 minutes for that specific workday.

Now, we must convert the 7.22 hours into decimal hours. How do we convert hours into decimal hours? To do this, we leave the hour number and convert the minutes.

We already know the number of hours worked; now we’re looking for the percentage of the hours worked, a.k.a. the decimal!

The formula for converting minutes is: Minutes / 60

In the example, Carlos worked 7.22 hours.

Hours = 7

Minutes = 22/60 = .37

Decimal hours = 7 + .37 = 7.37

Therefore, Carlos worked 7.37 decimal hours.

Now, we can accurately calculate payroll based on these figures!

If Carlos gets paid $20.00 per hour, we simply multiply that by 7.37

20 x 7.37 = 147.40

Following our time formula and decimal hour calculations, we find that Carlos got paid $147.40 for that specific workday.

Account for Non-Paid Periods

When learning how to calculate hours worked, remember to include non-paid periods of the workday!

Non-paid periods are the time during work hours that is spent on breaks or mealtimes. Unless otherwise stipulated, these are non-paid periods of worker’s time and need to be deducted from the total hours worked.

For example, if Sarah works 8.75 decimal hours but has a lunch break of 45 minutes, it’s important to subtract that time.

Decimal = 45/60 = .75

Payable Hours = 8.75 - .75 = 8.00

So, in total, Sarah has 8 payable hours worked.

As you can see, the process can be straightforward, but it does include many steps and numbers. We’ll have more information about streamlining this process below.

Of course, there is a need to properly track and save team members' working hours when learning how to calculate hours worked. It’s important to be able to do this accurately and effectively, so where to start?

How Do I Keep Track of My Employee Hours?

There are a variety of options out there to keep track of your team’s hours. Each option has its own benefits and downsides, and the type of time-tracking you use for your field service team will likely change over time according to your needs.

The best method for a business depends on the number of crew members you have and what your company does. For instance, the type of time-tracking that an office environment might use will benefit because the team all comes to the same building to work. Field service crews don’t have that benefit, so your time-tracking system will need to be as flexible as you are!

Let’s break down the ways you can keep track of employee hours:

1. Handwritten: The Pen and Paper Method

Using the pen and paper method of tracking hours is considered ‘old school.’ The pen-and-paper method is just what it is- tracking time using a pen and a piece of paper or time card.

The benefits include the fact that hours can be recorded immediately, as the timesheet can be taken wherever a crew member works, and they’re the simplest way to record time. It remained a popular choice for field service teams as the nature of their jobs meant they needed to take their timesheets and documents with them.

However, there are plenty of downsides to this system. It’s error-prone, both when physical timesheets are filled out and when they’re processed. It’s easy to miss or add a number when writing and submitting these time sheets. When it comes to how to calculate hours worked at the end of the work period, those little mistakes can have knock-on effects.

2. Time Clocks

Time clocks are a method of collecting data on precisely when a crew member clocks in and out. There are two types: mechanical and electrical.

Mechanical time clocks are devices that record work hours on a physical card. Team members place their time cards into the machine, and it marks the card with the time and date. Mechanical time clocks are reliable as they cannot be adjusted to fake times, but it is important to ensure employees use the time cards properly.

An electric time clock is similar, but these devices use electronic methods to verify the time and can record the results. Team members can use a badge, password, and/or handprint. Some even use facial recognition! These hours can be recorded digitally or on a paper time card.

The advantages of time clocks are they are difficult to tamper with and accurately record the time and date on a time sheet. A team member needs to be physically present at work, which is both a benefit as times cannot be fudged but it can also be a disadvantage for field service businesses. Coming to a specific physical location may be a challenging process for your team and can cost time and money.

3. Automatic Time Tracking Software

Automatic time-tracking software is the easiest and most efficient way to keep track of your employee hours. It combines the advantages of time clocks and the pen-and-paper method into one easy package.

Automatic time tracking software can be downloaded as an application to your mobile devices, which means field service crew don’t have to worry about returning to a specific location to clock in/out or making errors with handwritten time sheets.

Many companies specifically provide the services you need to keep track of hours. ClockShark does just that and even more!

ClockShark is a powerful and easy-to-use online service that tracks your crew’s location and hours. This product is built specifically for construction and field service companies and has everything you need to track hours, crew and more.

Benefits of ClockShark as a Time Clock Software for Tracking Crew Member Hours

ClockShark has a variety of resources available that will help you track team member hours and calculate payroll, taking off the stress of manual timesheets and processing.

Here are a few of the many resources we provide:

Calculate Worked Hours

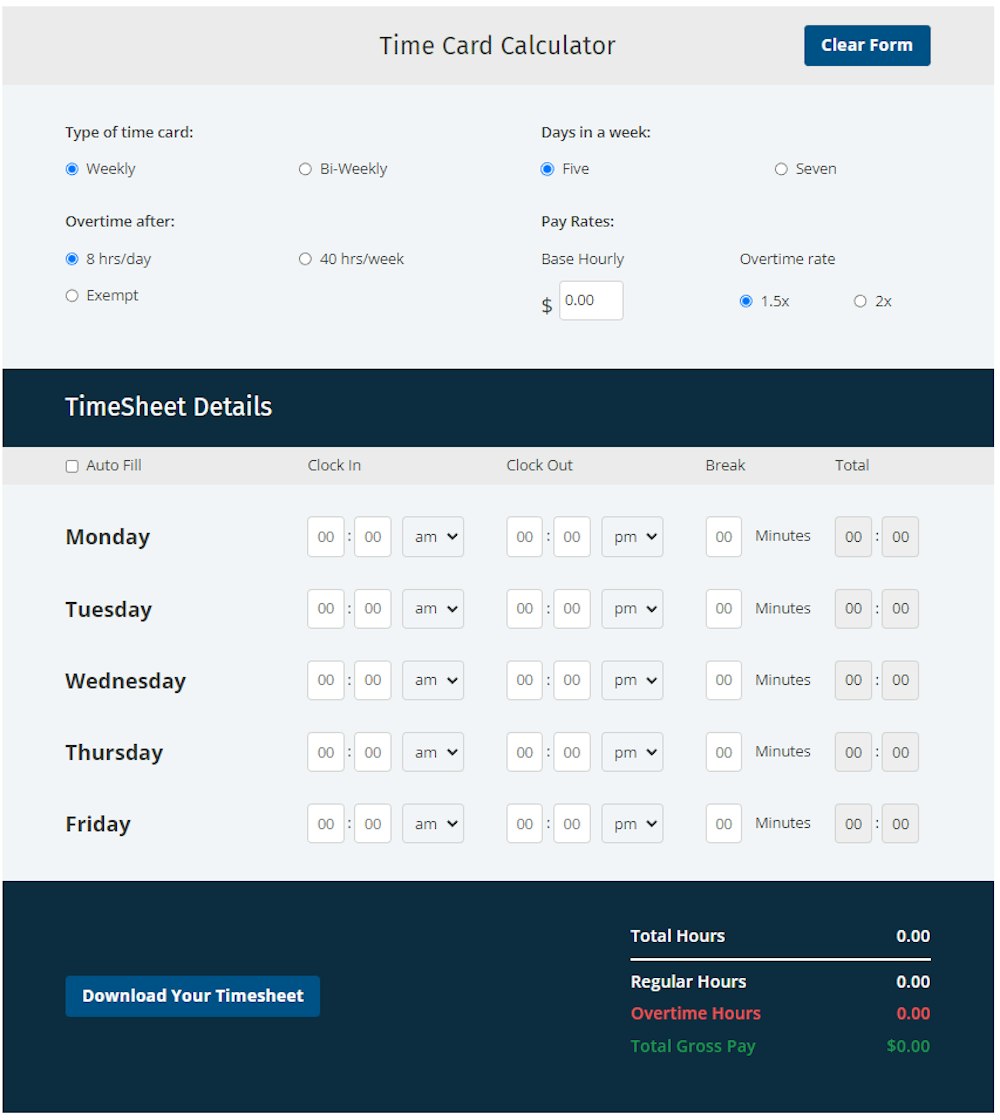

Need a faster and more efficient way to calculate worked hours? With ClockShark’s Timesheet Calculator, you put your team members' worked hours and pay rate, and we will calculate hours worked, their pay, and even overtime!

Free Resources

In a previous blog post: “Employee Timesheet Template - Free Download for Excel,” we provided an easy-to-use downloadable timesheet template. This free resource is a handy tool to organize and easily track worker’s hours.

Favourite Software Integrations

With integrations such as QuickBooks and ADP® available on our paid subscriptions, the pain that comes with payroll is put at ease. Calculating payroll takes seconds with our helpful and easy-to-use integrations.

Stress-Free Hour Rounding

When calculating employee hours, you have to face the issue of ‘time rounding.’ Time rounding is the practice of rounding employee time to the nearest increment.

For example, if an employee clocks out at 4:56 p.m., you round it up to 5:00 p.m. for the purpose of payroll. This also works the other way. If someone clocks out at 4:51, we would round down to 4:45. Handle rounding in the app and set your policies to manage time and money!

Get Timely Insights

With ClockShark’s accurate and timely timesheets and payroll, get insights into the effectiveness of your team on the ground and on their devices. Knowledge about your crew’s work and productivity is key to growing your business.

Goodbye to Inaccuracies

The stress of inaccurate employee hours is solved with ClockShark! Employees can track and even edit their work hours on any smart device using the ClockShark app. This handy app is available on iPhone and Android.

ClockShark strives to make life easier for field service and construction business owners! Use our free resources to get quicker and more accurate payroll for your team!

Streamline Your Approach to Time-Tracking

Calculating employee worked hours can be tough, but it doesn’t have to be when you have the right resources. ClockShark offers free resources that you can utilize when it comes to calculating payroll. It’s time to start calculating employee hours pain-free.