All businesses need to have strong bookkeeping systems in place, but bookkeeping for construction companies is different from other businesses.

You need to have accurate bookkeeping not just for the sake of taxes and potential audits, but to monitor your cash flow and ensure you’re being compliant and profitable.

This guide to construction bookkeeping will give you the best practices when managing your books and performing accounting tasks.

The Importance of Construction Bookkeeping

If you don’t have a highly accurate and efficient construction bookkeeping system, the rest of your business will suffer.

Bookkeeping for construction companies helps you accurately track your income and expenses, so you can easily make adjustments when needed and better manage your projects. Without good bookkeeping, you risk going over budget on projects and not having the cash flow to cover your expenses.

Construction Accounting Vs. General Accounting

All businesses need to use accounting. Each business needs to have a general ledger and records of accounts payable and receivable. General accounting requires people to use Generally Accepted Accounting Principles (GAAP), as does construction accounting. However, construction accounting is different.

What Makes Construction Accounting Different?

Aside from following GAAP, construction accounting must also follow the guidelines laid out by Standards Codification 606 (ASC 606) which is an accounting code established by the Financial Accounting Standards Board (FASB). The ASC 606 applies to construction companies because of the nature of their revenue. There are other aspects of construction accounting that make it unique from general accounting, as well.

Project-Based

Since construction companies have projects, they need a specialized way to perform revenue recognition as part of the ASC 606. Each step of the ASC 606 has a detailed list of guidelines, but the six steps include:

- Identify the contract with a customer

- Identify the performance obligations in the contract

- Determine the transaction price

- Allocate the transaction price

- Recognize revenue when or as the entity satisfies the performance obligation

And since each project is different - even if it’s the same type of project - the revenue recognition needs to be unique to each one which means your accounting and bookkeeping workflow needs to be as simple as possible to avoid mistakes.

Relies On Long-Term Contracts

Most contractors are paid for projects that take months or years. Regardless of the type of payment schedule you use for each contract, long-term contracts require meticulous bookkeeping records.

Decentralized

Many construction companies have multiple projects happening at the same time. This poses a challenge for construction bookkeeping professionals, as they need to be able to gather the necessary information from multiple sites and sources and be confident the information is accurate and complete.

Government Contracts

Many construction firms enter into government contracts, where paperwork and records are essential to getting paid. Even the slightest error or typo can delay payment. These types of contracts require thorough, complete, and accurate bookkeeping records.

Retainage

Construction has a unique type of payment structure that includes retainage, Retainage is the amount of money that clients withhold until they are satisfied with a project. When you have multiple projects going on, you need reliable and strong retainage management to ensure you have capital in case the client withholds the money. Obviously, this cannot be accomplished without strong bookkeeping practices.

Variability

The construction industry is highly susceptible to political and economic fluctuations that disrupt the supply chain. Costs of materials, equipment, and labor shift unexpectedly. Things can happen beyond your control to destabilize your cash flow, such as bad weather conditions or a piece of equipment breaking down.

Construction Bookkeeping Best Practices

If you’re not the bookkeeping type, you may find bookkeeping tasks mundane and frustrating, but getting it right is extremely important. If you don’t intend to hire a professional, follow these best practices for construction bookkeeping to keep your financial records updated.

1. Keep Track Of Daily Transactions

Every transaction should be recorded, whether it’s for buying fuel for the company vehicle or receiving a large shipment of lumber. The size of the transaction does not matter; Each transaction is important to keeping accurate bookkeeping records.

It’s important to track not just expenses but income, as well. Develop an easy-to-follow system and create a habit of recording each transaction at the end of each workday.

2. Use Job Costing

Whether you use a job costing software or perform job costing manually, it’s an important part of your bookkeeping process because it helps you track the expenses associated with a project.

One way to job cost is to break the project down into phases, and then list all the tasks needed to complete each phase. Divide the tasks into one of three categories:

- Labor

- Materials

- Overhead

Track these expenses throughout each phase of the project to help you stay within your

budget.

3. Automate Your Bookkeeping

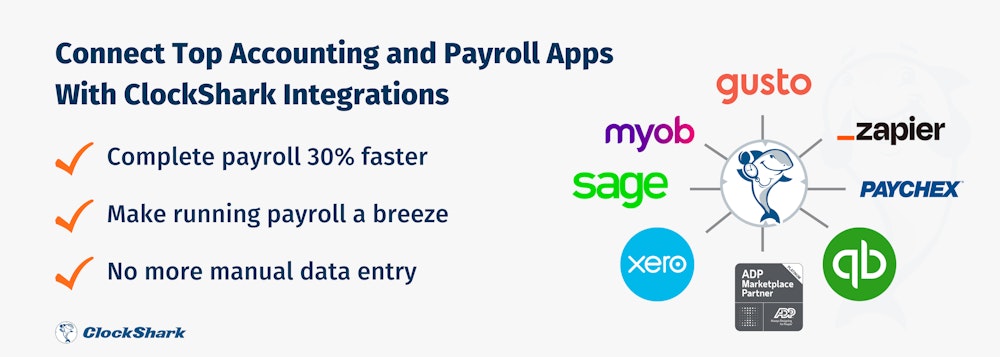

You may not be able to automate all of your bookkeeping, but there are parts of it that will make it much easier to do. Even if you hire a professional firm, having an automated system that collects and stores the information will make it easier for them to perform your bookkeeping tasks. Plus, automation eliminates the risk of human error when tracking expenses and revenue and makes it easier for you to share your information.

4. Back Up Records Digitally

Nothing would be worse than losing years of data to a computer crash or natural disaster. It’s smart to have duplicates of all your records in case something like this happens. In many cases, you need to have your financial records for at least three to seven years (varying by state and type of record) so losing them would cause a lot of problems.

Even better is to back up your records onto a cloud service, so they’re accessible from anywhere.

5. Leverage Accounting Software

Accounting software makes it easier to keep your records accurate, neat, and tidy. Most business owners are familiar with the name QuickBooks - one of the more popular types of accounting software - but there are other accounting software available, many geared specifically towards the construction industry. With accounting software, you simply enter the data and the software puts it where it needs to go.

Save Time and Money with ClockShark

Choosing The Right Bookkeeping Software

There is a lot of construction software out there for today’s construction firms to choose from. Ideally, a construction software that automates some - or all - of your bookkeeping would make running your business a lot easier.

Here are some things to look for when choosing the right bookkeeping software for your construction business.

Look For Compatibility

Since construction accounting is different from general accounting and you need to keep extra meticulous records, you need to be sure the bookkeeping software you choose is compatible with the construction industry.

You should also ensure it’s compatible with the size and type of company you have.

Identify Must-Have Features

Nobody knows your business as well as you do so before looking for a bookkeeping software, determine the things you absolutely need it to do. Key features helpful for construction firms include:

- Basic accounting features that allow you to manage accounts payable and receivable and your company’s general ledger.

- Expense management, so you can easily and quickly enter and record your expenses as they happen so you know where your money is going.

- Bank account reconciliation with your financial records.

- Billing and invoicing that make sending invoices easier and more professional.

- Payroll management that allows you to track and approve employees’ times and process payroll.

- Reporting so you have quick and easy access to the financial reports you need.

Prioritize Ease Of Use And Flexibility

It would do little good to get a tool that can’t be used. Before choosing a bookkeeping software, ask if they offer a free trial and use that time to get familiar with the way it works. If it’s too clunky or complicated, you might want to choose something else. On the other hand, if it’s super easy to use but doesn’t provide the flexibility you need, you should consider trying a different one.

Cloud-Based

A cloud-based solution makes it easier to access your financial records because the information is stored on an external server. Using a cloud-based service also ensures the security of your information because it is encrypted and safe from hackers, power outages, disasters, or computer malfunctions.

Take Control of Your Construction Bookkeeping

Not everyone is cut out to be a bookkeeper or financial expert but software makes doing these things much easier today.

Construction bookkeeping is unique because of the nature of the business, so it’s even more important to hone your bookkeeping skills and use the best tools available, to make sure it’s done right.