Many construction and field service companies want to switch from outdated paper timesheet practices to paperless timesheets because it automates their time tracking and payroll processes and simplifies clocking in and out for their employees.

It also makes administrative tasks like payroll, job costing, invoicing, and more, much easier, faster, and more accurate by removing the risk of human error.

However, frequently there is concern about how to make the shift. Where does one even begin? What will my employees think? Can they even do it? Is it really worth the trouble? How can I reassure them?

This post aims to address these questions and help you make the switch from old-fashioned timekeeping techniques that are costing you time and money, to a paperless timesheet solution that makes time tracking and payroll much easier.

Benefits of Time Tracking Automation

1. Estimating and Billing

Numbers are the base of every business. Having an accurate log of hours worked, job expenses, project needs, and productivity level determine what materials need to be ordered, whether to hire more employees and how business practices can be improved.

Accurate job costing data can help you gauge pricing and find areas that can be fine-tuned to produce better results. It can also keep track of hours spent on projects and reduce the chances of overtime, saving you money and getting results faster.

In construction especially it’s critical to manage projects accurately. Staying on budget and on schedule is good for your business and means your clients are happy.

2. Save Time

Automated time tracking frees up time spent on manual timekeeping methods and the inconveniences that come with them. With more time on their hands, management can focus on driving the business forward. Employees spend less time completing and entering time cards and more time completing productive work.

3. Manage Overtime

Overtime is inevitable. Projects with tight deadlines will often need employees working overtime to make sure the job is done on time. Automated time tracking apps make sure that overtime is approved and is within the budget, helping you avoid going over budget due to mismanaged overtime.

Automated time tracking for construction workers also ensures that you’re up to speed on any state and federal laws regarding overtime as well as mandatory breaks.

4. Save Money

Old-fashioned paper time cards with hand-written hours can be a pain. On top of that, employees might write down incorrect hours, rounding up to hide a late arrival or early departure from work. This time theft means they’re being paid for hours that weren’t worked and slowing down the productivity of your business as a whole. Automated time tracking helps combat common time theft practices and makes sure that payroll is fair and accurate.

5. Avoid Time Theft

Mistakes happen, but when it comes to manual time tracking those mistakes can add up to real dollars and cents. The American Pay Association estimates that companies lose as much as 7% of their gross profit. When your business is small that can have a huge impact on the health of the company as a whole.

An automated time tracking app eliminates the mistakes and loopholes that exist with traditional timekeeping solutions and save your business money. When employee hours are accurately logged you avoid overpaying for hours not worked.

Automatic time tracking apps are a great solution to time theft issues in construction since they often use GPS and Geofencing features to automatically clock employees in once they reach a job site, and prevent them from clocking in before arriving.

When you have construction sites spread far and wide, the ability to set geographic barriers and automatically keep track of who is on-site takes the heavy lifting out of tracking time.

6. Reduce payroll errors

Business owners, managers, and supervisors can't be everywhere, all the time. Having to rely on outdated payroll management procedures is sure to cost you money. The use of employee time-tracking technology removes payroll errors in the following ways:

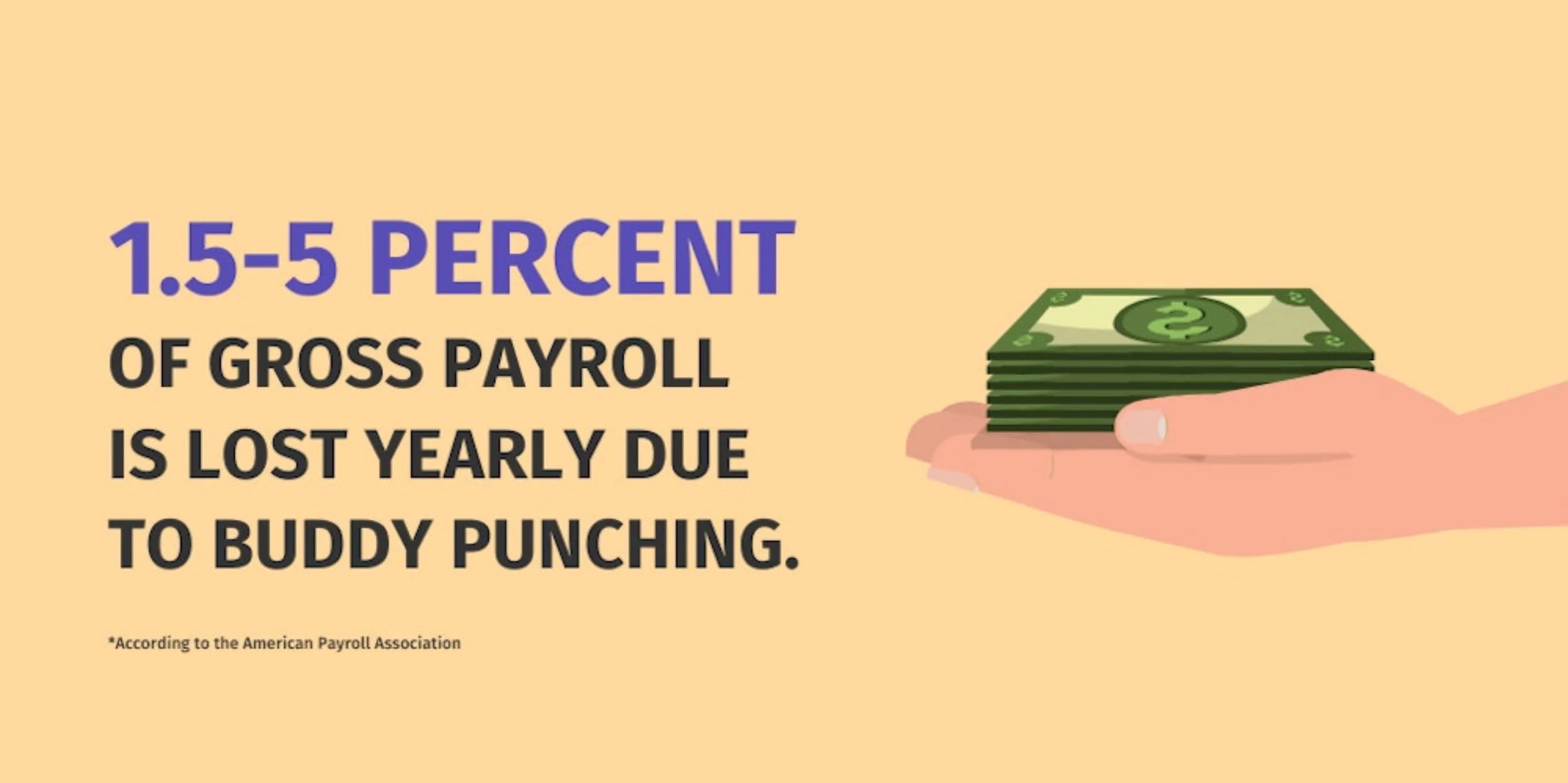

- No Buddy Punching: The American Payroll Association estimates a loss of 1.5 to 5 percent of gross payroll over a year due to buddy punching. With the use of biometric time trackers such as facial recognition, it is impossible for workers to punch in or out for one another.

- Accurate Time Keeping: Instead of risking over- or under-paying your employees with timesheet rounding, you are paying for exactly the number of hours they work, to the minute. You can also use automated time tracking to review accurate time reports and stay on top of overtime.

- Correct Time Spent On Tasks: Employee time tracking increases accountability in this way so you can make sure you are getting from your employees what you are paying for.

- Identify Outdated Policies/Procedures/Equipment: For example, if you have an exceptional employee who suddenly starts under-performing, it could be because they are working with a program or piece of equipment that needs to be replaced or repaired. Real-time tracking helps you identify such things, so you can make sure your employees can perform at their best.

- Speed Up Payroll Processes: Time-tracking technology will reduce the amount of time your payroll department spends on payroll management.

- Cut Down On Overtime Costs: Automated employee time tracking allows you to integrate with scheduling. This means you can review hours worked and make schedule changes quickly, easily, and accurately. This way you cut down on unauthorized (or unintended) overtime wages.

Why are people afraid of technology?

This is a common issue for newcomers to timesheet software. Not only a question of whether they can use it or not, but whether their workers will be adept enough to use it.

There's a term called "technophobia" which, as you may have guessed, means "fear of technology." We tend to get - and stay - comfortable with our areas of expertise. For example, you may have employees who are accustomed to writing down their hours every day who will feel uncomfortable switching to a modern time tracking system.

That's not uncommon, particularly for older generations.

Research has found that "non-digital adults [50–67 years] seem to experience computer-related anxiety, making them feel technophobic or unconfident regarding digital solutions."

Even for younger employees, just the prospect of change can be disruptive, and that's nothing new. Harvard Business Review reports the top ten reasons people resist change are:

- Loss of control

- Too much uncertainty

- Not being prepared/informed in advance

- Too many things changing at once

- Loss of face (the perception that their "old way" was "wrong")

- Fear of feeling stupid

- More work

- Ripple effect (fear it will create more change in the future)

- Past resentments (the resurfacing of old, unaddressed wounds)

- Real threats ("When new technologies displace old ones, jobs can be lost; prices can be cut; investments can be wiped out.")

These are legitimate reasons for fearing change and when you're going from paper timesheets to paperless timesheets, it's definitely a change.

But it doesn't have to be a massive shift that throws everyone off balance and gets fists waving in the air. In fact, adopted with these things in mind, the shift to automated timesheets can be painless and easy.

Most common employee pushback tactics

However, our own experience shows that 80 percent of employees not only comply with adopting technology but even appreciate it. Still, you should try to be prepared in case you have some employee pushback and resistance.

Your employees will likely fall into one of three categories:

- Fully accepting

- Accepting, but not happy about it

- Downright resent it

Thankfully, those who downright resent it are in the minority. You'll be ahead of the game by preparing yourself with the right answers for any one of these most common objections.

While it may feel overwhelming to have to deal with these objections, they are actually pretty easy to deal with as long as you accept them as legitimate concerns from your workers. Allow them to express these concerns and be prepared with the answers:

1. I refuse to use electronic time tracking.

Paperless timesheets are actually easier and more accurate than paper timesheets once you get used to it.

2. It doesn't work right on my device.

Most apps work with both iOS and Android.

3. I know I am punching in correctly, but it's not working.

Go over the clock-in and clock-out procedures with them to show them how simple it is.

4. I'm concerned about being tracked by GPS while I'm clocked in.

The GPS is only active while they are clocked in for work, and isn't any different than the fleet GPS tracking modules in trucks that have seen widespread use over the last ten years. Google's location services track where most users go, even without you being aware and many retail locations will send push notifications if they're notified you're in the vicinity. So GPS is nothing new.

5. I don't like using my own personal device for work (can be related to data use, battery drain, or just the principle)

Using personally owned things for work is commonplace. There's a growing trend in business of personally-owned work computing devices, termed BYOD (Bring Your Own Device). Not to mention, your employees likely provide some of their equipment already, such as PPE and hand tools.

6. I resent the implication that I am being dishonest about the hours I work.

Using timesheet software actually makes their jobs easier and helps the company grow as a whole. It is not a punishment, but an investment. When they start to see their paychecks coming in regularly and accurately, they will appreciate it.

7. If you start using a time tracking app, I will quit.

Your business is your responsibility, as are your workers. Maintaining compliance with FLSA and ensuring your employees are paid accurately is a critical part of having any organization. Anyone who wants to quit because you are trying to improve the way you run your business is probably not an asset anyway.

Ultimately, there is an answer for any concern your workers may have. The key is to be open and understanding. Since you know both change and technology can cause some distress, simply learning and being prepared is a great first step to overcoming the challenges of adopting technology.

First Steps

Once you decide paperless timesheets are best for your company, set up a meeting with your employees that will provide enough time for Q & A, training, and downloading the apps to their phones.

Before you choose which time tracking app to go with, research and make sure they have customer service that will walk you through the set-up process. Ensure you have a professional available, either remotely or in person, to provide tips and details on how to operate the software.

Make sure everyone understands the many ways this new technology is going to make their jobs better, improve their paydays, and help the company grow together overall. When everyone is onboard, it makes the transition much smoother.

ClockShark Lets You Take Control

It's true there are some very complex systems out there but time- and money-saving platforms don't have to be complex or expensive. Switching from paper timesheets to a simpler, more accurate time tracking solution will automate many of your processes. Paperless timesheets will streamline your payroll and help ensure your workers are paid accurately and on time.

Administrators can use automated timesheets to use new timesheet approvals, right from their computer.

Some companies choose to issue company-owned devices, but our internal experts generally recommend against this. Rather, a simple solution such as the CrewClock or KioskClock features remove the need for that by allowing supervisors to clock their crews in from one device or employees to clock in and out from a single device.

Save Time and Money with ClockShark

But if you want to continue using paper timesheets, we have an employee timesheet template and a free timesheet calculator you can use to try to keep your employees' hours straight.

If you're ready to give paperless timesheets a try, reach out to our five-star customer support team, or sign up to try ClockShark's award-winning timesheet software free for 14 days.